Long-Term Care Planning

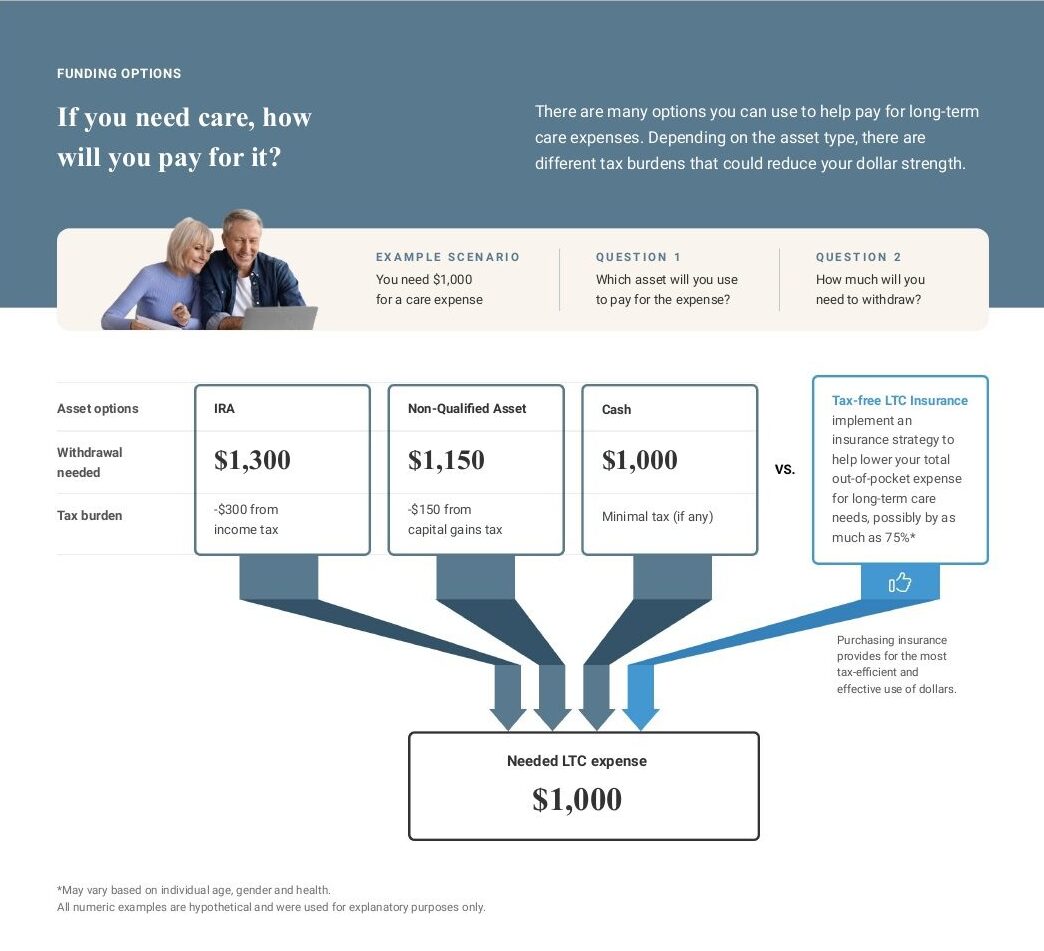

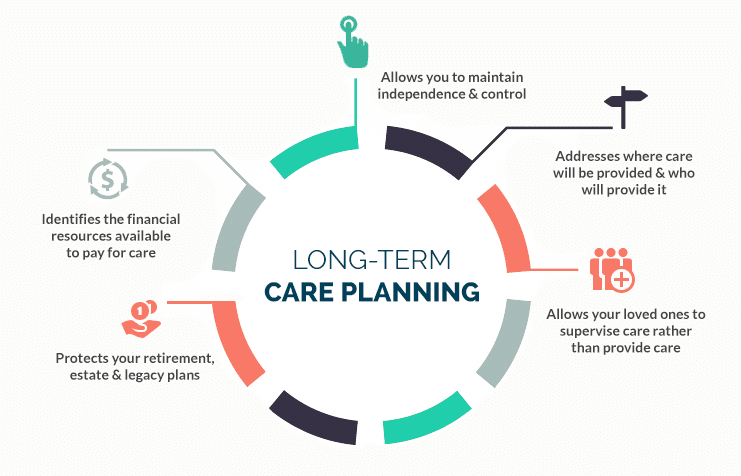

The need for extended care at home or in a facility such as Assisted Living can happen to anyone at any age due to an accident, injury, or illness; and it is a reality for 70% of us over the age of 65 due to normal aging, frailty, and dementia. Long-term care is an event (not a place) that impacts the lives of spouses and adult children who become caregivers. Neither Medicare, the Affordable Care Act, nor group health insurance pays for these non-medical services which can range from $5,000 to $20,000 or more each month. An extended healthcare event is unpredictable and costly; it’s the financial Wild Card that often disrupts retirement savings, investments, estate plans, and families. For those who want quality care in the setting of their choice, personal income, assets, or long-term care insurance remain the primary sources of funding. Medicaid helps those meeting certain financial requirements.

If you had an extended health care event, do you worry that:

Breathe Easier Knowing Your Future is Planned and Secure

Why Others Have Chosen to Work with Brad

When others scheduled a chat with Brad, they sought peace of mind from knowing there was a plan for their future care.

You are probably no different.

Protection of your estate, independence, and the financial resources to pay for quality care in the setting of your choice are important to you; so is not putting a burden on family and loved ones.

However, you may think it is too expensive or not know who you can trust in this industry. It can all leave you feeling worried and anxious.

With one easy phone call, we can work through those fears and concerns and create a plan that works for you on every level. I am here to serve you and help you find the peace of mind you seek.

Endorsed by Dave Ramsey

Brad Tisdale is Dave Ramsey-endorsed in Long-Term Care Insurance, a process that includes being thoroughly vetted to ensure his ability to serve clients well, long after the purchase has.![]()